Running a successful business means keeping your finances organized and strategic. Two functions, bookkeeping and accounting, are often used interchangeably, but in reality, they serve different, complementary purposes. Bookkeeping focuses on maintaining accurate day-to-day records of transactions, while accounting interprets those records to provide insights, strategies, and compliance assurance.

This blog explores their key differences and overlaps in areas such as financial reporting, tax preparation, payroll management, auditing, and budget planning. Let’s dive in.

Financial Reporting Essentials

Accurate financial reporting is the backbone of any business. According to a PwC survey, 87% of CFOs say accurate reporting is essential for business resilience and investor confidence. Both bookkeeping and accounting contribute, but in distinct ways:

| Aspect | Bookkeeping Contribution | Accounting Contribution |

| Data Collection | Records daily transactions | Compiles, classifies, and interprets data |

| Financial Statements | Provides raw financial data | Prepares reports for stakeholders |

| Compliance Support | Maintains accurate records | Ensures adherence to standards (GAAP/IFRS) |

| Decision-Making | Supplies basic numbers | Provides insights for strategic planning |

Tax Preparation and Compliance

Taxes are a universal responsibility, and both bookkeeping and accounting play crucial roles in ensuring businesses don’t run into trouble with regulators.

Bookkeepers act as the groundwork layer. They:

- Maintain receipts, invoices, and expense records.

- Ensure all taxable income and deductible expenses are accurately logged.

- Track sales tax, payroll tax, and other statutory dues.

Accountants, meanwhile, step in with strategy:

- Analyze the raw data to optimize tax liability.

- Prepare tax returns with compliance in mind.

- Advise on long-term tax strategies to reduce risk.

For example, the IRS estimates that around 20% of small businesses pay penalties every year for late or inaccurate filings. With precise bookkeeping and strategic accounting, that risk drops significantly.

Payroll Management in Bookkeeping and Accounting

Payroll is one of the most sensitive areas of financial management – employees expect to be paid accurately and on time, and regulators expect compliance with tax laws. Bookkeeping and accounting work hand-in-hand to keep this process seamless.

Bookkeeping covers:

- Recording employee hours, salaries, and wages.

- Logging payroll deductions and benefits.

- Ensuring all payroll transactions are entered correctly into the ledger.

Accounting, on the other hand:

- Reviews compliance with tax regulations (e.g., FICA, Medicare, and state taxes).

- Prepares reports for management on payroll costs.

- Advises on financial planning related to compensation and benefits.

A 2023 QuickBooks survey found that 42% of small business owners spend more than 80 hours annually on payroll compliance. That’s two full work weeks – time that could be saved by aligning bookkeeping and accounting more efficiently.

Financial Analysis and Insights

While bookkeeping maintains the financial pulse of the business, accounting turns that data into meaningful insights. Businesses that use financial analysis effectively grow 30% faster, according to the Small Business Administration.

Bookkeeping provides the raw inputs:

- Income and expense details.

- Records of assets and liabilities.

- Transaction history across periods.

Accounting applies analysis:

- Identifies profitability trends.

- Forecasts future revenue and expenses.

- Evaluates efficiency with ratios (e.g., debt-to-equity, current ratio).

In other words, bookkeeping is the “what,” and accounting is the “so what.” One records the story, and the other interprets it to guide decisions.

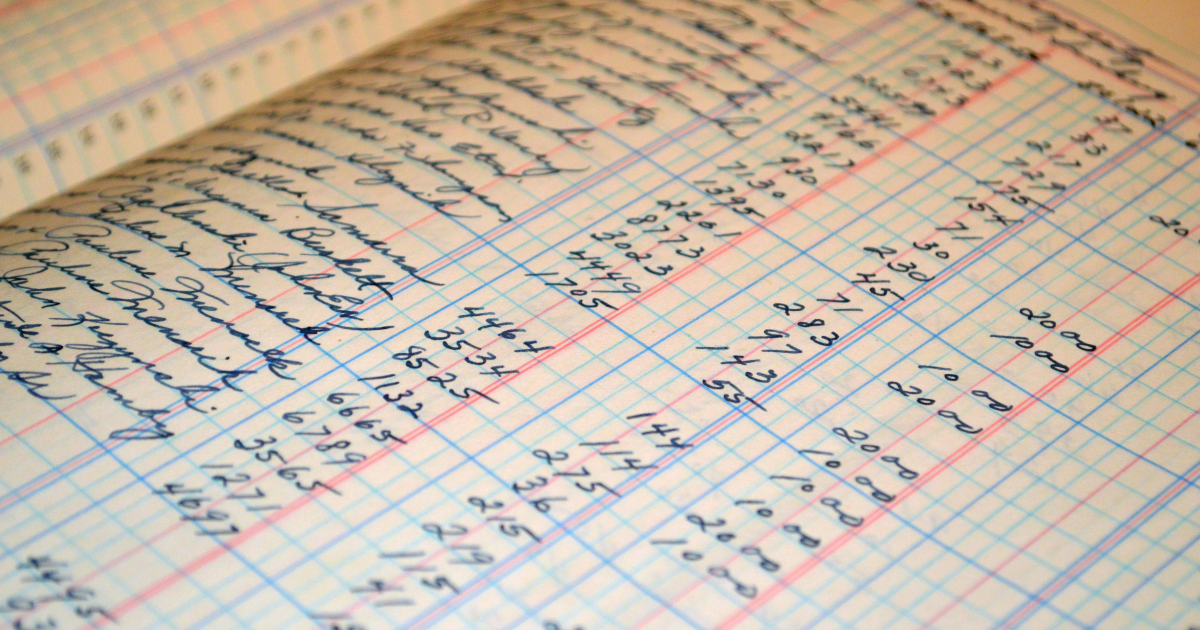

Ledger Maintenance and Organization

Ledgers are the foundation of financial organization. Without them, reporting, tax compliance, and audits would crumble. Here’s how bookkeeping and accounting divide responsibilities:

- Bookkeeping: Handles daily entries – sales, purchases, payments, and receipts – ensuring nothing is missed.

- Accounting: Adjusts for accruals, depreciation, and reconciles discrepancies in the ledger.

Auditing Services: Ensuring Accuracy and Compliance

Audits are intimidating for many businesses, but they don’t have to be if bookkeeping and accounting are in sync.

Bookkeeping contributes by:

- Keeping transaction records transparent and traceable.

- Maintaining receipts, invoices, and reconciled statements that auditors need.

Accounting takes the lead by:

- Conducting internal audits to check accuracy.

- Coordinating with external auditors for compliance.

- Reviewing financial statements against regulatory requirements.

Interestingly, the Association of Certified Fraud Examiners (ACFE) reports that poor record-keeping is one of the top three causes of financial mismanagement uncovered in audits. That underlines how vital bookkeeping is in supporting effective auditing.

Budget Planning and Financial Strategy

Budgeting is where numbers transform into action plans. Businesses that actively plan and monitor budgets have 30% better growth rates than those that don’t. Bookkeeping supports budgeting by:

- Providing accurate data on past expenses and revenues.

- Highlighting recurring costs and income streams.

- Offering a snapshot of cash flow trends.

Accounting then builds strategy by:

- Forecasting future financial performance.

- Allocating resources to maximize profitability.

- Offering contingency planning for risks.

The Symbiotic Relationship Between Bookkeeping and Accounting

While they differ in scope, bookkeeping and accounting are two sides of the same coin. Bookkeeping handles the groundwork – accuracy, detail, and structure – while accounting elevates that groundwork into strategy, compliance, and analysis.

Here’s a quick summary table that ties everything together:

| Area | Bookkeeping’s Role | Accounting’s Role |

| Financial Reporting | Records accurate data | Prepares statements and insights |

| Tax Compliance | Maintains tax records | Develops tax strategies |

| Financial Analysis | Provides data | Interprets and strategizes |

| Ledger Maintenance | Daily entries | Adjustments and reconciliation |

| Budgeting | Supplies data for planning | Strategies for future growth |

Ready to Simplify Your Finances With Indigo Billing?

Managing numbers doesn’t have to be overwhelming. At Indigo Billing, we know that every business has its own rhythm, and financial management should fit seamlessly into that flow. Our team provides tailored bookkeeping and accounting services that go beyond just keeping the books balanced – we help you stay compliant, plan strategically, and make confident decisions backed by accurate data.

From day-to-day transaction recording to tax preparation, payroll management, and long-term financial strategy, Indigo Billing handles the details so you can focus on what you do best: growing your business. Whether you’re a small startup or an established company, our approach is designed to scale with you, offering clarity and peace of mind at every stage.

Let Indigo Billing turn your numbers into insights and your goals into action. It’s time to simplify your finances, reduce stress, and unlock your full business potential.

FAQs

- How does bookkeeping contribute to accurate financial reporting and ledger maintenance?

Bookkeeping ensures every transaction, income, expense, or adjustment is recorded accurately and consistently. This organized ledger provides the foundation for financial reporting, making it easier to prepare precise statements and spot discrepancies early.

- What is the role of accounting in tax preparation and compliance for businesses?

Accounting goes beyond record-keeping by analyzing financial data to prepare accurate tax returns and reduce liabilities. It ensures compliance with regulations while also providing strategies to optimize tax outcomes for the business.

- How do bookkeeping and accounting work together in payroll management for efficient transaction recording and oversight?

Bookkeepers track payroll transactions and log wages, deductions, and benefits correctly. Accountants then review compliance, generate reports, and provide oversight, creating a seamless process that keeps employees paid and the business compliant.

- In what ways does bookkeeping provide essential data for financial analysis and auditing services?

Bookkeeping supplies the raw, detailed records – such as expenses, revenues, and receipts – that auditors and analysts rely on. This data becomes the baseline for identifying patterns, verifying compliance, and supporting deeper financial evaluations.

- How does accounting enhance budget planning and the development of strategic financial strategies?

Accounting uses historical bookkeeping data to forecast future performance, allocate resources, and design financial strategies. It transforms numbers into actionable plans, helping businesses grow sustainably while preparing for risks and opportunities.